Short Position Swap . swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. Swap long (used for keeping long positions open. a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers to the interest either earned or paid for a trading position that. there are two types of swaps: interest rate swaps are an integral part of the fixed income market. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of.

from analystprep.com

a short position is created when an investor sells a security they do not own, with the intention of buying it back at. there are two types of swaps: Swap long (used for keeping long positions open. interest rate swaps are an integral part of the fixed income market. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers to the interest either earned or paid for a trading position that.

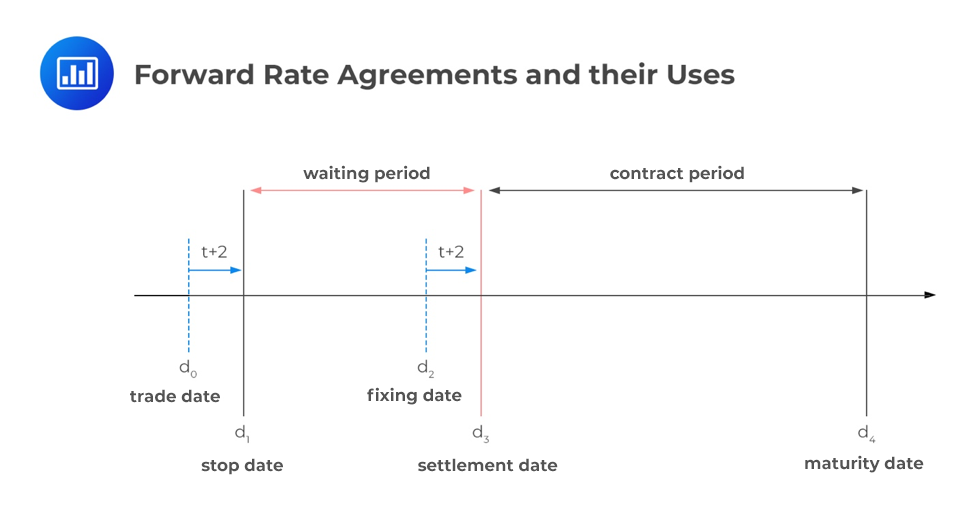

Define Forward Rate Agreement (FRA) CFA Level 1 AnalystPrep

Short Position Swap there are two types of swaps: interest rate swaps are an integral part of the fixed income market. there are two types of swaps: In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers to the interest either earned or paid for a trading position that. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. Swap long (used for keeping long positions open. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific.

From www.hourly.io

How to Make Shift Swapping Easy for Your Team Hourly, Inc. Short Position Swap there are two types of swaps: a short position is created when an investor sells a security they do not own, with the intention of buying it back at. Swap long (used for keeping long positions open. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a. Short Position Swap.

From blog.roboforex.com

Explaining the Meaning of a Swap on Forex Examples of Use Short Position Swap In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific. there are two types of swaps: Swap long (used for keeping long positions open. interest. Short Position Swap.

From spreadsheetplanet.com

How to Swap Columns in Excel? 5 Easy Ways! Short Position Swap a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers to the interest either earned or paid for a trading position that. interest rate swaps are an integral part of the fixed income market. a short position is created when an investor sells a security they do not own, with. Short Position Swap.

From taniforex.com

Difference between Swap Long And Swap Short Tani Forex Short Position Swap In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers to the interest either earned or paid for a trading position that. interest rate swaps are an integral part of. Short Position Swap.

From www.reddit.com

💫Swapping provides flexibility and allows us to quickly gain the Short Position Swap In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. there are two types of swaps: Swap long (used for keeping long positions open. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific. a. Short Position Swap.

From www.tradingview.com

OKX Perpetual Swap Position Sizer by RainbowLabs — Indicator by Short Position Swap interest rate swaps are an integral part of the fixed income market. Swap long (used for keeping long positions open. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash. Short Position Swap.

From www.gabler-banklexikon.de

ShortPosition • Definition Gabler Banklexikon Short Position Swap In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. Swap long (used for keeping long positions open. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific. there are two types of swaps: interest. Short Position Swap.

From www.babypips.com

Rollover Fee Definition Forexpedia™ by Short Position Swap there are two types of swaps: a short position is created when an investor sells a security they do not own, with the intention of buying it back at. interest rate swaps are an integral part of the fixed income market. a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover. Short Position Swap.

From analystprep.com

Comparison of Swaps and Forward Contracts AnalystPrep CFA® Exam Short Position Swap there are two types of swaps: a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers to the interest either earned or paid for a trading position that. interest rate swaps are an integral part of the fixed income market. Swap long (used for keeping long positions open. a. Short Position Swap.

From www.ifcmarkets.com

SWAP Rate Calculation Swap Currency Example Long Swap Short Swap Short Position Swap In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. there are two types of swaps: Swap long (used for keeping long positions open.. Short Position Swap.

From celebrites.tn

What is swap explain with example? Short Position Swap there are two types of swaps: a short position is created when an investor sells a security they do not own, with the intention of buying it back at. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. interest rate swaps are an integral part. Short Position Swap.

From www.bodybuilding.com

5 "Shortcut to Size" Exercise Swaps Short Position Swap Swap long (used for keeping long positions open. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a swap in foreign exchange (forex). Short Position Swap.

From www.facebook.com

Swap positions of two objects in PowerPoint in a single click! Quickly Short Position Swap Swap long (used for keeping long positions open. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. interest rate swaps are an integral part of the fixed income market. In finance, a swap is a derivative contract in which one party exchanges or swaps. Short Position Swap.

From www.differencebetween.com

Difference Between Options and Swaps Compare the Difference Between Short Position Swap interest rate swaps are an integral part of the fixed income market. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. Swap long (used for keeping long positions open. a swap in foreign exchange (forex) trading, also known as forex swap or forex rollover rate, refers. Short Position Swap.

From www.gabler-banklexikon.de

ShortPosition • Definition Gabler Banklexikon Short Position Swap there are two types of swaps: In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. swaps are derivative instruments that represent an. Short Position Swap.

From emozzy.com

What Is Swap in Forex Trading & How Does It Works? Short Position Swap a short position is created when an investor sells a security they do not own, with the intention of buying it back at. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. swaps are derivative instruments that represent an agreement between two parties to exchange a. Short Position Swap.

From www.investopedia.com

Swap Definition & How to Calculate Gains Short Position Swap interest rate swaps are an integral part of the fixed income market. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a specific. a short position. Short Position Swap.

From www.reddit.com

Position Exchange's Swap🔥 r/PositionExchange Short Position Swap Swap long (used for keeping long positions open. In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of. a short position is created when an investor sells a security they do not own, with the intention of buying it back at. swaps are derivative instruments that represent. Short Position Swap.